Google on Tuesday formally introduced its lengthy expected Google Pay app, which mixes the options of the previous Android Pay and Google Pockets into one platform, with new advantages designed to boost up cellular fee use and store participation.

The alternate, initially introduced closing month, represents a bid to enlarge the usage of Google’s rising ecosystem to tackle each Apple and Amazon within the e-commerce house, the place the usage of contactless bills methods has been on the upward thrust.

Combining the apps will lead to advantages for Google consumers and builders alike, famous Gerardo Capiel, product control director for shopper bills, and Varouj Chitilian, engineering director for shopper bills, in a web based submit.

“We’re recently operating on bringing Google Pay to all Google merchandise, so whether or not you’re buying groceries on Chrome or along with your Assistant, you’ll have a constant checkout revel in the usage of the playing cards you’ve stored for your Google account,” they wrote.

Function Recent

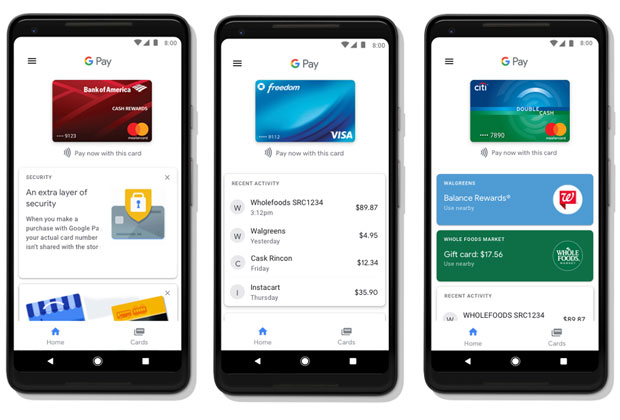

The brand new Google Pay house tab will come with knowledge on contemporary purchases, show close by shops that settle for the app, have details about rewards and be offering recommendations on how you can use. A playing cards faucet assists in keeping observe of your credit score and debit playing cards, loyalty playing cards, bargain gives or even present playing cards.

Click on Symbol to Magnify

Google Pay recently is permitted on quite a lot of transit methods all over the world, together with in Kiev and London, in addition to in Portland, Oregon, and it’s going to enlarge to further towns.

Common Android Pay options corresponding to further safety, financial institution perks and coverage also are to be had in Google Pay.

As a substitute of getting to fill out bureaucracy that require monetary knowledge, consumers can simply make a choice Google Pay and try with a couple of clicks on the check in. Additionally, consumers within the U.S. and UK will have the ability to ship and obtain cash, beginning in a couple of months.

The Pockets app is now known as “Google Pay Ship.”

A significant reason why for combining the apps’ capability in Google Pay is to enlarge the patron belief past the cellular software. Google plans to enlarge e-commerce transactions to Google House and different units to compete with Amazon Echo, which owns the profitable new voice-activated buying groceries house.

“They’re converting the identify as a result of Android is particular to cellular units,” stated Chad Lowman, director of mission control at Cayan.

“There’s a wide variety of alternative to make use of the pockets in different platforms, corresponding to e-commerce,” he informed the E-Trade Instances.

Google closing yr introduced a program with TriMet, the general public transit machine in Portland, to create the Hop FastPass — the primary digital transit card to be to be had on Android Pay. The beta take a look at concerned TriMet, C-TRAN and Portland Streetcar customers who had been in a position to faucet their telephones to pay for commuter journeys.

In take a look at runs up to now, Google Pay now not most effective has helped shoppers skip lengthy traces at native outlets for transit playing cards, but in addition made it more straightforward to shop for tickets and board native commuter traces, serving to the transit suppliers cut back the amount of money they’ve to procedure.

“There’s indubitably some back-end advantages,” stated TriMet spokesperson Roberta Altstadt.

Safety Swipe

Cellular fee apps were catching on with some shoppers.

The extra she makes use of Apple Pay at outlets, the extra she prefers it to conventional credit score and debit card use, stated Paula Rosenblum, managing spouse with RSR Analysis.

“I actually favor exposing my debit card to as few outlets as conceivable — and it’s simple,” she informed the E-Trade Instances. “I stay moderately befuddled on the wish to scribble my identify on a receipt once I’ve activated the fee with a fingerprint, however it’s it seems that a contractual legal responsibility.”

Some of the arguments for the usage of fee apps is that buyers don’t have to go into their fee knowledge on the checkout counter.

On the other hand, contactless apps don’t seem to be utterly foolproof, cautioned Andrew Howard, leader safety officer at Kudelski Safety.

As with every virtual software, “assaults towards virtual fee strategies are conceivable, and there were assaults previously,” he informed the E-Trade Instances.

Apple Pay used to be prone to assault, both via infecting a jailbroken software with malware or via intercepting or manipulating SSL transaction site visitors, Sure Applied sciences demonstrated las summer season.

Apple didn’t reply to our request to remark for this tale.